The Evergrande episode is nothing more than a classic Barney Madoff Ponzi scheme that involves property developers and greed-driven investors. This kind of business generally forgets about the existence of risk while running after high returns. As with all successful Ponzi schemes, Evergrande’s became a Global Fortune 500 business with the help of new fools ready to transfer their money as “investments” in the Evergrande scheme.

Overwhelmed by the flood of incoming investment money, Evergrande churned out almost 70% of apartment buildings of “Ghost Cities” across China. They did so while selling the ridiculous idea that these apartments will serve as retirement assets for the millions of Chinese citizens who “invested” in their construction. As long as the buildings kept going up – and the bonds also were paid on time – every investor started to believe that they are getting rich.

Madoff was laughing out loud from his grave.

Because it’s is a repeat of the same Madoff scandal, but on a significantly larger scale. The Evergrande Ponzi scheme includes at least $300 billion in direct debt, and almost a trillion-dollar as the ripple effect of this direct debt.

The collapse has only just begun… and China’s FAKE economy is in real trouble

Ponzi schemes collapse when people demand to get paid back for their “investments” but the schemers can’t ensnare enough new investors to fund the previous ones who want pay-out. And for Evergrande, investors do not mean only the general public, their major investors are Banks. Around 124 Banks and a few hundred co-operatives are their investors. Even foreign banks have invested a good sum of money in the Evergrande Scheme. Banks and financial institutions around the world borrowed cheap money to invest in Evergrande where they could bank on far higher returns.

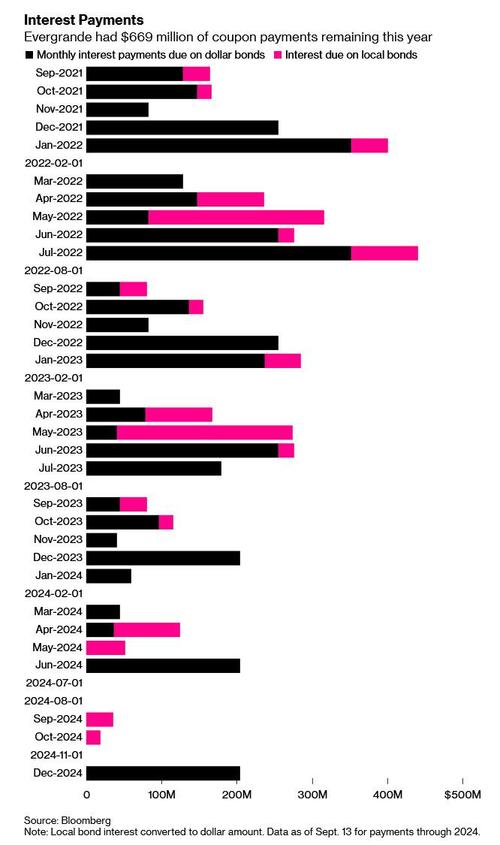

Evergrande owes $669 million in interest debt payments over the next 3 months.

According to recent news out of China, it looks like the government there is going to help cover Evergrande’s debt payments to local bondholders (i.e. institutions in China) while stiffing foreign bondholders.

This is a sure-fire recipe for causing the financial default to spread internationally:

One look at the debt obligations chart should lead to the instant realization that Evergrande is going to default… and foreign debt holders are going to be left high and dry. Even if the Chinese government covers all the individual local investors and their WMPs (Wealth Management Product investments), it’s clear that hundreds of billions of dollars in foreign-held debt is going to be written off at some point (probably soon).

Even worse, Evergrande is just the tip of the iceberg.

“The whole Chinese property market is on stilts,” investment expert Jim Chanos told the Financial Times. “…All the developers look like this. There’s lots of Evergrandes out there in China — Evergrande just happens to be one of the biggest.”

That means U.S. banks and institutions that invested in Evergrande are going to suffer catastrophic losses. Hence the ripple effect begins, and the non-China investors who had exposure to all this suddenly find themselves unable to make their own debt obligation payments for their own leveraged borrowing.

The bottom line result is that Evergrande’s collapse will almost certainly set off fiscal contagion. The debt implosion will likely spread, and if regulators aren’t able to expertly navigate the magnitude of this collapse, it may turn into an avalanche of failed institutions and banks around the world in 2022.

Of course, It’ll take time. It won’t be instantaneous. The first big collapse has started and begun to spread. Like a tsunami travels mostly unseen until it reaches shores, this catastrophe too can only be measured after the ripple reach the foreign shores.

Bernie Madoff’s Ponzi scheme ignited a $363 billion exodus by investors. This is way bigger than Madoff and the exodus will be much bigger too.

Whereas, Mr Uday Kotak and PM Modi’s joint efforts have succeeded in saving the same kind of situation in India. Finance company, Infrastructure Leasing and Financial Services (IL&FS), which is going through an insolvency process, said that it has settled Rs. 43,000 crores out of its total debt of more than 99,000 crore rupees (Debt Repayment). Along with this, the debt recovery target has been increased by Rs 5000 crore. In other words, the company’s debt recovery target for the financial year 2021-22 has increased from Rs 56,000 crore to Rs 61,000 crore. The company has paid off its debt by selling its assets and out of cash received from other sources. Thanks to PM Modi and his honest efforts to recognise the points on which India should work for a better and stronger economy. Steady and consistent efforts are being made to strengthen the pillars of the economy. Hiding the dirt under the carpet to look clean will certainly make one sick someday. That day is near for China.