The Indian stock market is going through a tough time right now. For five months in a row, it has been falling, which hasn’t happened since 1996 – nearly 30 years ago! This has many investors worried, especially those who have money in mutual funds.

What’s Happening?

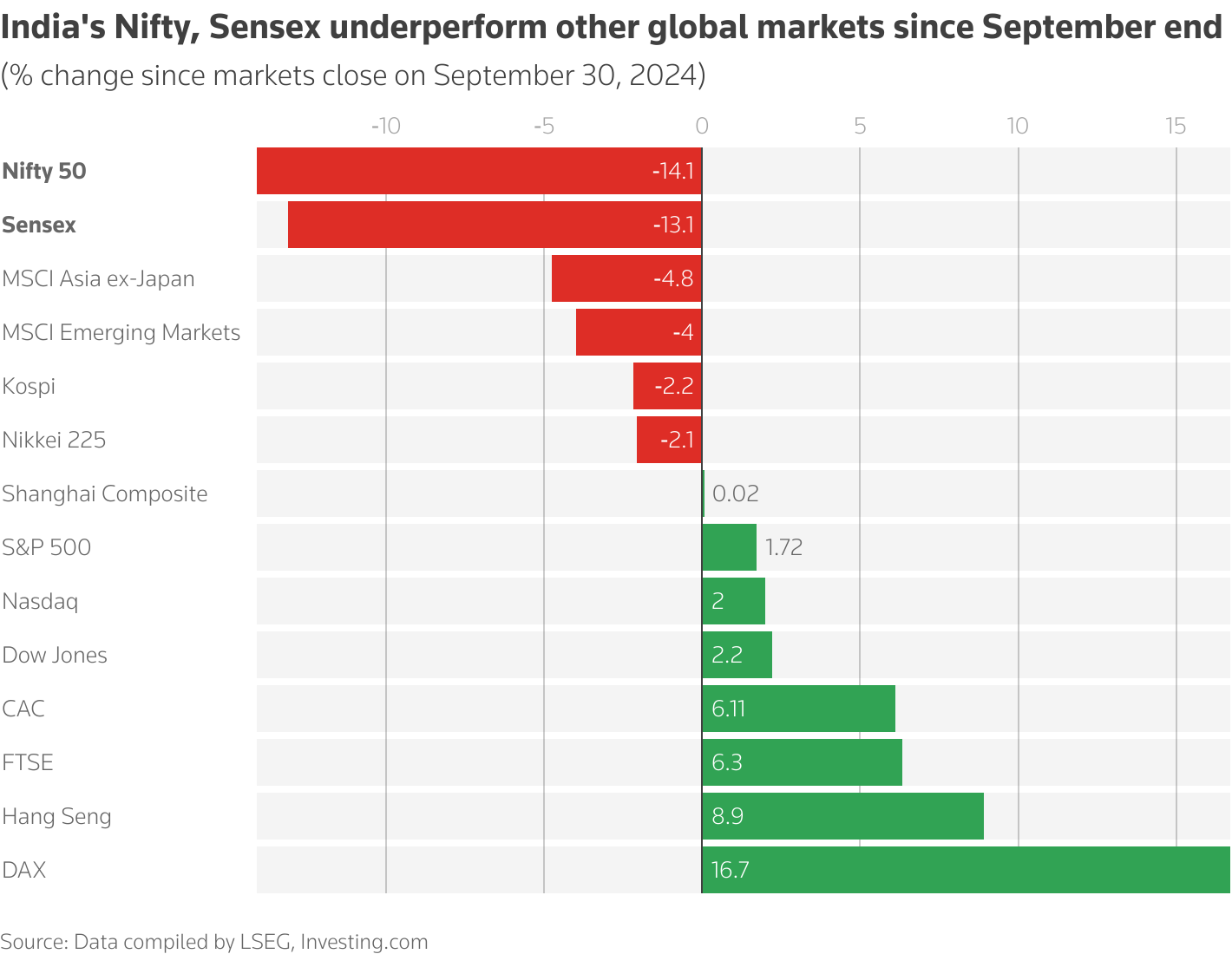

The two main Indian stock market indicators – the Nifty and the Sensex – have fallen about 13-14% since October. This is surprising because India usually performs better than other global markets, but right now it’s actually doing worse than most. While stock markets in Germany, Hong Kong, and the US are doing well (some even up by 2%), India is at the bottom of the chart.

This falling trend has wiped out about $1 trillion in wealth from the Indian market. Foreign investors, who used to put a lot of money into Indian stocks, have pulled out about $25 billion recently. In January and February alone, they took out $12 billion.

Global Market Performance Comparison

India’s Nifty, Sensex underperform other Global Markets since September 2024 end

www.anindyanandi.com

Why Is This Happening?

There are several reasons for this downward trend:

- Slow Company Growth: Big Indian companies aren't making as much profit as expected. The earnings growth of the top 50 companies (Nifty50) is only about 5% for the October-December quarter. This is the third quarter in a row with single-digit growth, after years of double-digit increases.

- Weak Consumer Spending: People in urban India aren't buying as much because prices are high, salaries haven't grown much, and inflation is eating away at their savings. Things like healthcare and education costs are going up by 14-15% a year! This means people have less money to spend on other things.

- Banking Concerns: There are rumours that Indian banks might show weak earnings for the January-March quarter. Since banking stocks have been holding up better than others, bad news in this sector could hurt the market even more.

- Global Factors: Donald Trump has threatened to put tariffs (extra taxes) on imports from Canada and Mexico. China has said it will do the same to US products if that happens. This fear of a global trade war is making investors nervous worldwide.

- The "Sell India, Buy China" Trend: Many investors are taking money out of India and putting it into Chinese stocks instead. China's market seems more attractive right now, especially after recent developments in AI technology (like Deep Seek) that have made investors excited about Chinese tech companies.

- Falling Rupee: The Indian rupee is getting weaker against the US dollar, which is another worry for investors.

Will It Get Worse?

Looking at the charts and expert opinions, it seems like this downward trend might continue for a little while longer. However, there's some good news too - expectations for the next financial year (starting April 2025) are much better. Experts think that government actions like tax breaks and increased spending will help the economy recover.

What Should Investors Do?

If you're a long-term investor who doesn't need this money right away, most experts suggest staying invested. Historically, the Indian market has always recovered and gone up over time, even after bad periods.

In fact, some see this as a buying opportunity - a chance to get stocks "on discount." If you're doing monthly SIPs (Systematic Investment Plans) in mutual funds, it might be a good idea to continue or even add a bit more if you can.

However, if you need the money in the next few months, or if you're extremely worried and can't handle further drops, you might consider taking some money out. Just remember that trying to time the market perfectly (taking money out now and putting it back in when prices are lowest) is extremely difficult even for professionals.

The key is to think about your own financial goals and timeline, and not to make sudden decisions based on short-term market movements. For most people who are investing for long-term goals like retirement or children's education, patience is usually the best strategy.

The market may show signs of improvement after the end of the current financial year. Mid-April or Early May 25 may show some signs of relief.